A burger restaurant in Danville, Illinois is at the center of a social media storm that began with a response to a bumper sticker displayed in the establishment. One former customer of Gross’ Burgers shared the controversial signage on Facebook calling it “absolutely disgusting.” Which it is, for the record. Now, a battle has begun and there is seemingly no end in sight.

Danville citizen Sam Schnelle posted a photo of the bumper sticker in question to her Facebook on April 26th. The sticker reads “If you can’t read this, thank a Marine,” and displays an arrow pointing to an Arabic phrase. The sticker also flaunts the United States Marine Corp. acronym.

Schnelle’s post quickly went viral, garnering over 1,100 reactions, 870 shares, and 3,600 comments. And as you’ve probably already guessed, the comments section is basically a full-on war zone.

At first, the responses to Schnelle’s post were of disgust. “This is terrible,” one Facebook user commented. Another said, “Never eating there again!” One local Danville resident added, “We’re calling them now. Or leave them a review on their page. Boycott until they take it down.” This comment alone got 20 positive reactions.

“I’m from Westville, born and raised, and I’ve always loved your food,” one Facebook user commented. “Now, my MUSLIM, ARAB family loves eating your food. What in the actual fuck is wrong with you Gross’ Burgers!?!”

“I’d be so happy to sit down and have an honest, respectful conversation about what Islam is really about,” she continued. “This is insane.”

Sam Schnelle / Facebook

For the most part, everyone on the post seemed to be in agreement. This sign, which implies that it’s wrong to be Muslim or be able to read Arabic, is pretty freaking offensive.

Sam Schnelle / Facebook

Schnelle’s post turned many people off from wanting to eat at Gross’ Burgers ever again. This political sticker left a bad taste in everyone’s mouths.

Sam Schnelle / Facebook

However, it didn’t take long until the pro-Gross’ camp caught wind of Schnelle’s “attack campaign.” These comments —

Sam Schnelle / Facebook

— soon turned into these comments. Surprise, surprise.

Sam Schnelle / Facebook

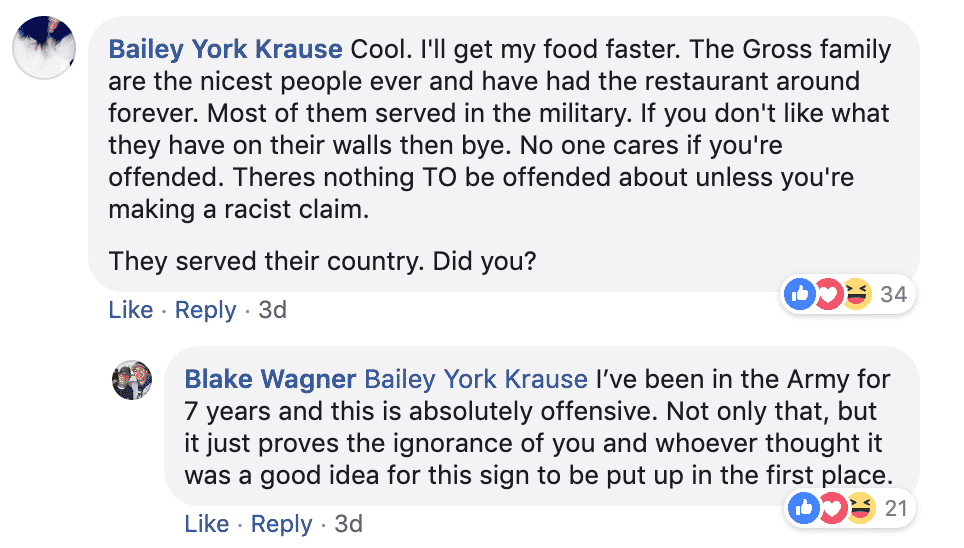

Other Facebook users joined the chat and urged Schnelle and anyone else who took offense to the bumper sticker to just “get over it.” It turned ugly — and fast.

Sam Schnelle / Facebook

The argument that people who find this offensive have no respect for the military just doesn’t make much sense. But… alas.

Sam Schnelle / Facebook

The same day she made her initial post, Schnelle took it upon herself to call Gross’ Burgers and ask them to take down the sign.

“They then handed the phone to the manager who said, “We are most certainly not taking it down. YOU PEOPLE are too sensitive now a days.” And then proceeded to argue with whatever recommendations/points I made and then hung up on me,” she wrote in a separate post.

Brad Gross, owner of Gross’ Burgers, told local station WCIA that the sticker has been on display in his restaurant for 10 years. It was given to Gross by a former Marine who asked Gross to display the sticker at the restaurant.

On Sunday, April 28th, a lone protester carrying a sign written in Arabic attempted to protest Gross’ display of the sticker. She was met by a hoard of counter-protestors dressed in patriotic attire.

Due to the outpouring of support for Gross, it doesn’t seem like the sticker is going anywhere anytime soon. And Gross doesn’t seem like he’s feeling threatened by those who are reportedly boycotting his restaurant.

The social media sensation has become a real-life feud. We’re honestly enraged.

In a final attempt to deliver a death blow to the racist sticker, Schnelle talked to a Marine who put the message into perspective. “The message on the sticker is not representative of the Marine Corps or its ethos,” the Marine told her.

“There is nothing honorable about disparaging other people’s languages and cultures,” the Marine continued. “The sticker represents blatant ignorance.”

Sam Schnelle / Facebook

Unfortunately, no matter how many points are made or arguments are heard, there will always be two firm sides of this debate. Especially in this political climate.

What are your thoughts on the Gross’ Burger bumper sticker situation? Would you boycott?