McDonald’s Changes Pricing in Response to Penny Shortage

McDonald’s customers are noticing a small but surprising change at the counter. Some restaurants across the U.S. have started rounding cash payments to the nearest nickel.

After the U.S. Mint stopped making one-cent coins earlier this year, retailers from grocery chains to fast-food outlets have been scrambling to adapt, and McDonald’s is now taking its own approach to keep transactions running smoothly.

The End of the Penny

The penny officially went out of production this spring, after former President Donald Trump ordered the Treasury to stop minting the coin as part of a cost-cutting measure. Each penny cost nearly four cents to produce. The move was meant to save money, but it created an unexpected side effect: a nationwide shortage of small change that’s now hitting everyday purchases.

Why Retailers Are Running Short

With no new coins being minted, banks have been rationing their supplies, leaving businesses to find creative workarounds. Retailers like Kroger and Home Depot have already asked customers to pay with exact change or switch to cards. CBS News reports that some stores are even offering small credits to shoppers who bring in spare coins. For many businesses, the penny shortage has become an ongoing headache.

McDonald’s Makes the Switch

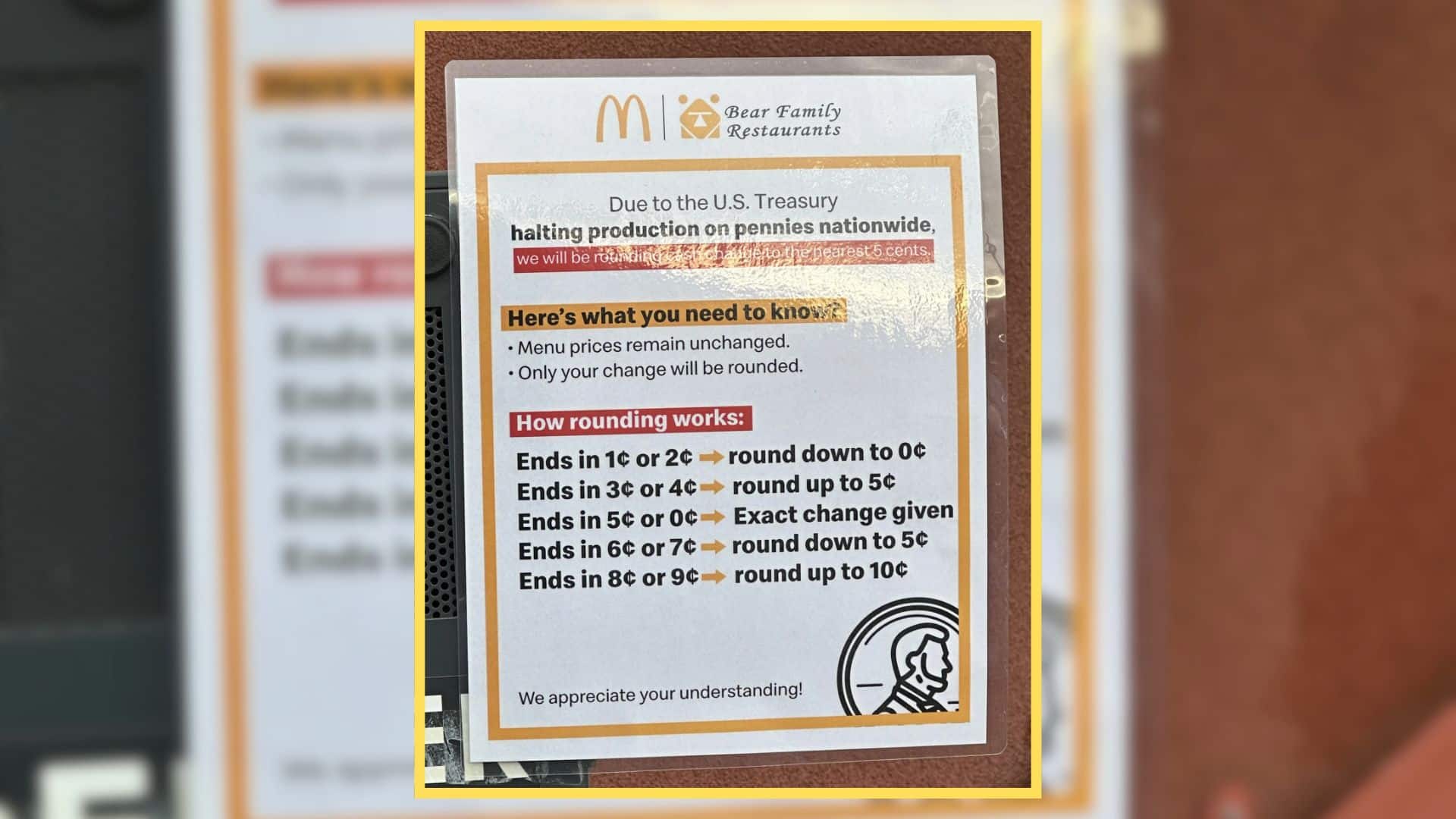

McDonald’s confirmed that several of its restaurants have begun rounding cash transactions up or down to the nearest five cents. In a statement to USA Today, the company said the change only affects cash purchases and is intended to “keep things simple and fair.” Digital and card payments, which make up most orders, remain unchanged.

How Rounding Works

Here’s how it plays out: if your total comes to $8.02, it’s rounded down to $8.00. If it’s $9.03, it rounds up to $9.05. The adjustment keeps prices consistent without changing menu costs or affecting taxes. McDonald’s says it’s following similar practices already used in Canada and Australia, where low-value coins were phased out years ago.

Customers React

While most customers barely notice the difference, not everyone is happy about it. Some have taken to social media to complain that it feels like “a sneaky price increase,” while others say it’s long overdue. “Canada did this years ago and survived,” one commenter joked on X. Others worry that rounding could add up over time, especially for people who still rely on cash rather than cards or apps.

Why It’s Happening Now

The rounding policy is part of a larger ripple effect caused by what Reuters called a “nationwide coin crunch.” With about 1/3 of Federal Reserve coin terminals no longer processing pennies, local shortages are appearing in cities across the country. And while there are billions of pennies still in circulation, many are sitting unused in jars or drawers rather than in registers.

A Sign of the Times

Cash payments have been steadily declining for years, now accounting for less than one in five transactions, according to Federal Reserve data. The penny shortage, and McDonald’s rounding system, simply highlight how quickly everyday commerce is moving toward digital payments. For cash users, though, these small changes serve as a reminder that the transition isn’t always seamless.

What It Means for Customers

McDonald’s rounding policy is expected to stay in place as long as the penny shortage continues. The company hasn’t announced any permanent pricing adjustments and says the move won’t affect digital orders. For now, it’s just another small shift in how customers pay, one that shows how even the smallest coin can leave a big impact on everyday life.